|

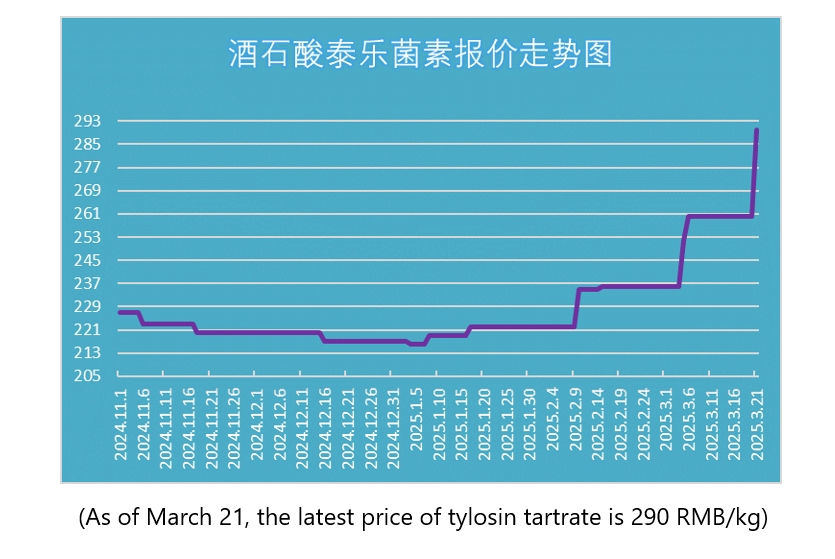

During the turbulent first quarter of 2025 in the veterinary drug raw material market, the price curve of Tylosin Tartrate has shown a steep upward trajectory. As of March 21, Ningxia Taiyixin Biology’s quoted price for tylosin tartrate reached 290 RMB/kg (with actual transaction prices at 280 RMB/kg), marking a cumulative increase of 23.5% from the beginning of the year and setting a two-year high for the product. While this market anomaly appears superficially driven by production capacity contraction, it fundamentally reflects the profound transformation of China’s veterinary pharmaceutical industry from extensive expansion to a model driven by high-end branding and technology-driven innovation.

I. Capacity Transfer Driven by Industrial Upgrading

The strategic adjustments of leading enterprises are by no means short - term behaviors. TOP5 enterprises such as Taiyixin and Qilu have switched their tylosin production lines to high - value - added products like tylvalosin and lincomycin hydrochloride. Behind this is the sharp differentiation of per - ton benefits - the profit margin of new veterinary drug raw materials is 3 - 5 times higher than that of traditional products. This capacity migration resonates with the EU's 2024 regulations on the use of new antibiotics, prompting global veterinary drug R & D resources to incline towards third - generation macrolide drugs. It is worth noting that TOP5 enterprises have actually controlled 70% of the market bargaining power, and the price formation mechanism is shifting from free competition to peer coordination

II. Three - dimensional Evolution of the Supply - Demand Contradiction

At present, the market presents a typical triple - superposition effect: As a key intermediate for new veterinary drugs such as tilmicosin and tylvalosin, the consumption of tylosin tartrate shows exponential growth with the increasing demand for downstream products; The surge in the demand for therapeutic drugs brought about by the scale - rate of pig farming exceeding 65%; The new EU regulations forcing export - oriented breeding enterprises to increase the proportion of compliant drug use. The inventory turnover days have dropped sharply from the normal 45 days to 5 days, forcing downstream enterprises to accept the "weekly price - negotiation" model. The procurement inquiry volume in March has increased by 180% year - on - year, and the market buffer mechanism has completely failed.

Ⅲ.Price Resilience Constructed by Clinical Rigid Demand

As the world - recognized first - choice drug for mycoplasma infection, its irreplaceability stems from its unique pharmacokinetic characteristics: reaching peak concentration in 2 hours and being completely metabolized in 72 hours. This not only meets the epidemic prevention and control efficiency of modern farming but also complies with the latest EU food safety residue standards. Clinical data show that rational use can reduce the incidence of respiratory diseases in pig herds by 42%, which is the core motivation for breeding enterprises to continue purchasing during the period of high feed costs. Under the trend of antibiotic - free farming, the characteristics of both treatment and growth - promotion functions further strengthen its market position.

Ⅳ.Transmission Mechanism of Price Adjustment by Mainstream Enterprises and Industry Synergy Effects

Market monitoring data shows that the pricing strategy adjustment of Ningxia Taiyixin Biology is reshaping the industry's price formation mechanism. As the only leading veterinary drug enterprise in China that masters the dual - fermentation method and 3E extraction technology to produce histamine - free tylosin tartrate, its quotation of 290 yuan/kg marks that the leading enterprise begins to dominate the distribution of high - end brand and technology premiums. This structural transfer of pricing power has triggered a chain reaction in the short term - TOP5 enterprises such as Qilu Pharmaceutical and Lukang Pharmaceutical have simultaneously raised their quotations, forming a clear price - following belt.

Behind this rapid synergy is the new game rule derived from the increase in industry concentration. TOP5 enterprises control more than 80% of the GMP - certified production capacity of bulk drugs. The high cost of switching their production devices, and the heavy - asset characteristics naturally curb the impulse of price wars. More crucially, the continuous price increase of chemical raw material procurement, the increased technological transformation investment brought by the new version of veterinary drug GMP certification, etc., make the unit cost curve of leading enterprises show a rigid upward - moving characteristic. High - end brand and technology premiums have become necessary means to maintain the rate of return.

The quotation difference of mainstream manufacturers has narrowed from ±12% in 2023 to about ±3%, and the coefficient of dispersion has reached a record low. The formation of this convergent pricing essentially stems from the convergent evolution of cost structures: when the substitution rate of synthetic biology technology applied by TOP5 enterprises all exceeds 75% and the extraction yield reaches over 90%, the differential barriers at the production end have been broken. The investigation by the China Veterinary Drug Association confirms that the standard deviation of the unit cost of tylosin tartrate of enterprises above a certain scale has decreased from 18.7 yuan/kg in 2020 to 5.3 yuan/kg in 2024. The narrowing of the cost corridor has laid the foundation for unified pricing.

V. The Butterfly Effect of the Reconstruction of the International Supply Chain

The implementation of the new EU veterinary drug regulations has led to a 12% increase in the global demand for therapeutic veterinary drugs, with the Asia - Pacific region contributing the bulk of the increment. As the world's largest producer of tylosin tartrate, China's export volume accounts for 58% of the global trade volume. The sharp increase in international purchase orders has further aggravated the domestic imbalance between supply and demand. It is worth noting that the technological iteration of emerging producer countries such as Europe, India, and Vietnam lags behind, making it difficult to form an effective capacity supplement in the short term. This disruption in the international industrial pattern provides external support for the continuous upward trend of prices.

VI. The Triple Game in the Future Market

It has become an industry consensus that the price of tylosin tartrate will break through 350 yuan/kg in mid - April. However, a deeper industrial transformation is brewing: Small and medium - sized bulk drug factories are vying for a marginal profit margin of about 8% through process improvement; preparation enterprises are accelerating the research and development of alternative solutions such as tilmicosin phosphate; and leading enterprises are building technical barriers through patented high - end brand products such as "histamine - free tylosin tartrate". Under this diversified competition pattern, the price fluctuation of tylosin tartrate is not only a barometer of market supply and demand, but also a key indicator for observing whether China's veterinary drug industry can break through the "intermediate dependence".

VII. The Inevitable Trend of the Medium - and Long - Term Price Curve

Driven by the triple factors of industrial structure adjustment, rigid clinical demand, and the improvement of international standards, an average annual price increase of 15% - 20% in the next three years has a solid foundation. Especially with the arrival of the new veterinary drug production capacity release cycle predicted by the "China Veterinary Drug Raw Material Market White Paper", the strategic position of tylosin tartrate as a key intermediate will be further enhanced. It is expected that by 2026, the market share of this variety in the veterinary drug raw material market will climb from the current 18% to 25%, and the central price is expected to break through 500 yuan/kg.

|